🤝 Scaling Service x Andrew Bloch: how to sell an agency

OK, I’ve built a great agency. Now how do I sell this thing?

Scaling Service is a monthly newsletter from The Family. We interview agency founders and ask them about everything from funding to sales to exits.

This month we’re talking to Andrew Bloch – who founded, sold, and bought back Frank – to ask him… how exactly do you sell an agency? Next month we’re speaking to Shayoni Lynn about how getting her proposition right led to a flood of inbound queries.

Founding an agency is a little like being a secret agent: you should always know where the exit is.

As Andrew Bloch, who co-founded Frank PR in 2000 and then sold it on to Photon (which later became Enero) in 2007, puts it: "When you're starting an agency, even though the end might feel like it's years and years away, it's important to run the company in a manner that's going to best set you up for an exit."

You could be forgiven for thinking that Frank, the cool new kids on the block with a boardroom full of sand, might not go in for dull things like forecasts and spreadsheets. Hard numbers mate? Who needs them. But their early growth strategy was in fact built on a rigorous approach to financial management. (Not, you know, sand.)

This meant strong accountancy, easy to read numbers, and clear targets. "We almost ran it like we were reporting into someone else. And we were pretty tough on ourselves if we weren't hitting where we wanted to be." Ultimately, he suggests, "A good agency that's well run is always going to be attractive."

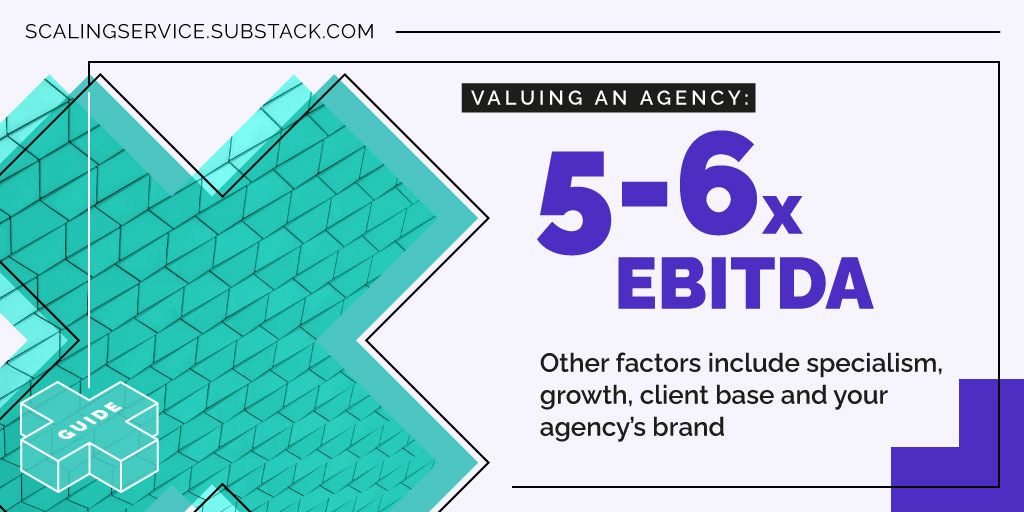

While it's hard to be precise across varied sectors, Bloch sketches out a few rules of thumb that make for a good exit moment. Around £1m in EBIT for the agency; about five or six times that for the offer. And, he stresses, "Timing is everything. You want to get the timing right."

It's a question of scale: not too big and not too small. "You have to look at what's going to be attractive to the other company: to the acquirer as well as the seller. They're looking for growth potential. They don't want to buy a company that has peaked. Too early, and there's just not enough profit that makes it worthwhile. Too late, and there's no more growth." And that's not just a problem for the buying company: most deals are structured with earn-outs following the upfront payment, and that is "where you can release most of the value".

Bloch, who is currently working with PCB Partners, also points to the importance of specialisation. Acquirers are looking to increase the breadth and depth of their services, and that means "looking for stuff they don't have". He points to B2B PR as one example, along with niches in healthcare and fintech. "What the big holding groups and the management services are trying to do is own that client relationship journey from beginning to end."

He's keen to stress, however, that there's more to selling up than just good numbers and a good fit. "There is a value that companies place on strong brands. Agencies almost become trophy acquisitions."

And with acquirers looking for excitement, for "hot, fresh, growing agencies", it pays to think about your market position from the outset. "If you're starting an agency today, one of the most important things to do is understand: How are you fresh and different from others out there?"

OK, I’ve built a great agency. Now how do I sell this thing?

So, you've got a strong brand, a decent client base, and the numbers are looking good. How do you go about selling?

Typically speaking, buyers will approach agencies rater than the other way around. Taking those calls – even if you’re not ready to sell – can be a great way to understand the process, and how to add more value to your agency.

If you’re a founder who’s looking to kickstart those conversations, your best bet is to approach a firm that specialises in mergers and acquisitions. Approaching buyers directly – such as big holding companies – does happen, but the standard approach is to go through an M&A firm. These companies can offer general consultancy on the process, will typically have a network of buyers ready to tap into, and can approach suitors on your behalf if not.

But Bloch emphasises that however you do it, you need to figure out what you want. Work out your value. And work out, too, what you are looking for in an acquirer. "All of a sudden, you've got a boss." He believes the key to good acquisition is to let the company maintain their personal investment in "their baby"; from a selling point of view, then, it's important to look for the deal that will allow you to keep that emotional connection alive.

"In the case of Frank, several people knocked on our door quite early in our journey. We had a number of conversations with those companies. And that helped us realise what a bad deal would look like, but also what the right deal would look like.

"Those early conversations, which started when we were around three or four years old, really helped us understand how we were valued and where we needed to be to achieve what we wanted." So when Photon came knocking, "We could see the path for the future, we could see the cultural fit, we could see how that helped us grow and build."

It took seven years to develop Frank from founding to sale, which Bloch describes as "pretty quick". Asked for a general timeframe, Bloch notes that it will vary from sector to sector, and reframes the question: "It's more about how quickly you can get to a certain scale in terms of revenue. You work towards that number, and you figure out what's right for you."

And that's the key: what's right for you. To know where the exit is, to be ready to use it when the moment comes, but not to obsess over it. "Just focus on doing what you love," says Bloch.

"Building a great agency, doing good work, hiring the best people, having the best clients. With Frank, we always understood that exit might be a route, but it wasn't what we were driving towards. We were driving towards being the defining consumer agency of our era, and everything went into that. Great work. I've always believed everything comes out of great work. You can stare at an Excel spreadsheet 24 hours a day, it doesn't make you a great agency."

Family affairs:

News from The Family and its portfolio agencies:

Hard Numbers and Hype Collective launches StaffSeed: ‘Work for us for four years and pitch us for funding for your own agency’ 🔗

Hard Numbers launches jobs newsletter: when they have jobs, they’ll ping you. When they don’t, they’ll leave your inbox in peace 🔗

Why did you buy it back? Did they muck it up? That's what happened to our business when we sold it!